Simplifying Taxation for MSMEs: File your BIR Form 0619E and 1601EQ even without an Accountant

- consult451

- Oct 24, 2023

- 9 min read

Updated: Nov 8, 2023

Hey! We’re back again to help you unlock a smoother, more efficient tax-filing process. As previously mentioned on our list of the 4 Common Tax Deadlines MSMEs should remember, BIR Form 0619E and BIR Form 1601EQ are two important tax forms that MSMEs need to be familiar with.

Understanding these forms is no walk in the park. But by the time you reach the end of this blog post, you'll be armed with the knowledge and understanding you need to successfully deal with BIR Forms 0619E and 1601EQ with confidence and clarity.

What is BIR Form 0619E and BIR Form 1601EQ?

The Expanded Withholding Tax (EWT), as defined by the Bureau of Internal Revenue (BIR), is - “a kind of withholding tax which is prescribed on certain income payments and is creditable against the income tax due of the payee for the taxable quarter/year in which the particular income was earned.”

To ensure a steady stream of revenue and to promote tax compliance, the law imposed that taxes must be collected from their corresponding sources. This means the payor is required to withhold a certain percentage of the payment and remit it directly to the BIR on behalf of the payee. The withheld amount is treated as an advance payment of the income tax liability of the payee.

The expanded withholding tax is reported regularly on a monthly basis using the BIR Form 0619E and on a quarterly basis through the BIR Form 1601EQ.

So, what is the difference between BIR Form 0619E and BIR Form 1601EQ? Besides their reporting frequency and deadline, the two forms are basically similar. The only difference is, in BIR Form 1601EQ, you’ll need to indicate the specific details regarding what you withheld. BIR Form 1601EQ also requires the submission of the Quarterly Alphalist of Payees (QAP) as its attachment.

QAP is a comprehensive list of the payees that you withheld taxes for during the specific quarter. It includes the names of the payees, their Tax Identification Number (TIN), the total income payment amounts, the withheld amounts, and the Alphanumeric Tax Code (ATC) utilized for each payee. The BIR assigns ATC to identify and categorize various sources of income subject to withholding tax. You can generate QAP using the BIR Module available on their website.

The EWT must be filed and remitted by the withholding agent. When a person makes a payment to a supplier or payee, they must deduct the appropriate withholding tax amount from the total payment. The specific amount to be deducted is determined based on a table of withholding tax rates that are applicable.

When should you file BIR 0619e and 1601EQ?

The BIR Form 0619e is filed monthly and should be submitted on or before the 10th day of the following month (e.g., EWT collected from your payees in August should be filed and remitted on or before September 10).

The BIR Form 1601EQ, however, should be filed not later than the last day of the month following the close of the quarter (e.g., EWT collected from your payees for the quarter July to September should be filed and the balance—net of July and August remittances remitted on or October 31).

How to compute the EWT?

The withholding amount is computed based on the BIR’s table of withholding tax rates. Some of the most commonly used tax rates are as follows:

Refer to this link for the complete withholding tax rates from BIR, or you can also download this printable pdf.

Example:

Business A, an MSME is renting a commercial space to Business C. The rent amounts to P15,000 monthly. The computation of the EWT will be:

EWT = Php 15,000 x 5%

EWT = Php 750

The total of Business A’s payable to Business C will be Php 14,250 (15,000- 750 EWT). Business A will need to issue a BIR 2307 to Business C while the withheld amount of

Php 750 will be included with the BIR Form 0619E for filing.

The BIR considers certain companies as ‘Top Withholding Agents.' These companies are required to withhold the following specific tax rates:

Example:

Business B, one of the BIR’s Top Withholding Agents, purchased office supplies amounting to Php 2,500 from Supplier A. The computation of the EWT will be:

EWT = Php 2,500 x 1%

EWT = Php 25

The total of Business B’s payable to Supplier A will be Php 2,475 (2,500- 25 EWT). Business B will need to issue a BIR 2307 to Supplier A, while the withheld amount of Php 25 will be included with the BIR Form 0619E for filing.

Always remember that withholding agents must provide the payee with a duly signed BIR Form 2307, also known as the ’Certificate of Creditable Tax Withheld at Source.’ BIR Form 2307 includes the withheld tax amount from the payments and will serve as proof for the payee to claim credit against their annual income tax return.

How to file 0619E for eBIRFORM Filers?

Done computing for the total withholding tax based on the income payments and the prescribed tax rates? It's now time to file your BIR Form 0619E.

Here’s a simple guide in filing for your BIR Form 0619E using the eBIRForm:

Step 1 - Make sure to download and install the latest version (Offline eBIRForms Package v7.9.4) of the Offline eBIRForms Package from the Bureau of Internal Revenue (BIR) website, https://www.bir.gov.ph/. Select “Use BIR Eservices.” Then click on the “eBIRForms” tab.

Step 2 - After installing, open the eBIRForms application on your computer. You will be directed to this Profile page below:

You will need to fill out the following information: TIN,RDO, Line of Business, Registered Business Name, Registered Address, Zip Code, Telephone Number, and Email Address. Make sure that your email address is valid. The BIR will send the Tax Confirmation Receipt to the email address you indicated when you filed using the eBIRForms.

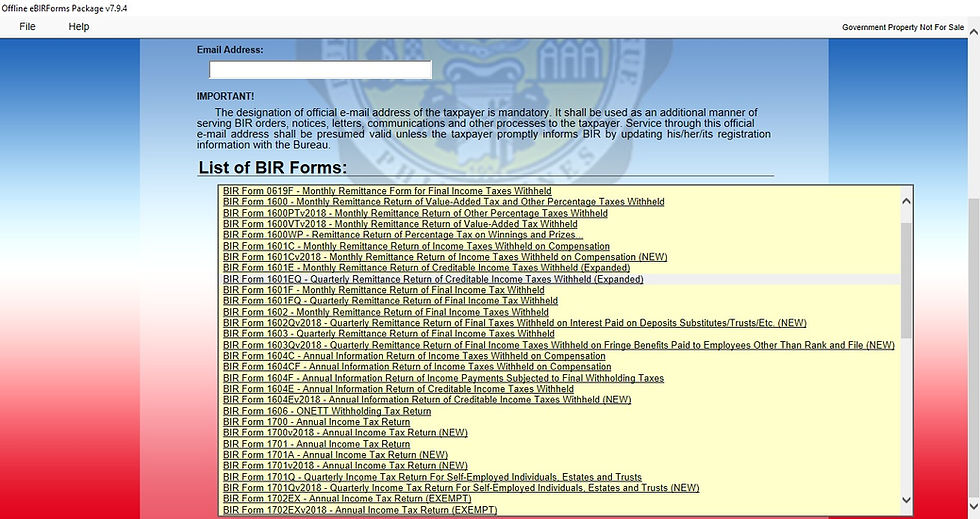

Step 3 - From the list of available forms, locate and select “BIR Form 0619E -Monthly Remittance Form for Creditable Income Taxes Withheld (Expanded).” See below for your reference:

Then click “Fill up.” You will be redirected to the 0619E form.

Step 4 - Provide all the required information on the form accurately. Enter the amount of remittance or the total withholding tax. Double-check the details to avoid errors that may lead to penalties or delays.

Step 5 - Click the "Validate" button on the lower portion of the form. This will help recheck the accuracy and completeness of the information you entered in the form. In case you have made erroneous responses or left some questions unanswered, an error message will be prompted. Address the indicated errors and make the necessary corrections. Once the validation is successful and there are no errors, click “Save.” This will save the form you filled up in the eBIRForm module.

Step 6 - To file your BIR Form 0619E, just click the “Submit / Final Copy” button.” Once you’re redirected to a BIR message, click “OK.” To obtain a copy of your submitted form, you may click the “File” button on the top portion of the form. Then click “Print,” to print a physical copy or print it as a pdf file to save a digital copy.

After filing, a tax confirmation receipt will be emailed to you through the email you entered in the Profile page.

Step 7 - Pay for the total tax payable. Make sure to follow the guidelines for payment, such as using the designated authorized banks or payment channels. You may refer to this link for the list of authorized banks and payment channels.

Step 8 - Don’t forget to keep copies of the forms or returns you submitted. The submitted BIR Form 0619E, the tax confirmation receipt, and the proof of payment will serve as proofs of your compliance.

How to file 1601EQ for eBIRFORM Filers?

After filing the BIR Form 0619E for the first two months of the quarter, withholding agents should also file the BIR Form 1601EQ to cover the entire three months of the quarter. Here’s a guide on how to file using eBIRForms:

Step 1 - Open the eBIRForm Filer.

Step 2 - From the list of available forms, locate and select “BIR Form 1601EQ - Quarterly Remittance Return of Creditable Income Taxes Withheld (Expanded).” See below for your reference:

Then click “Fill up.” You will be redirected to the form.

Step 3 - Provide all the required information on the form accurately. In the form you will see individual fields for the Remittance made in Total Amount Withheld: for the Quarter, the 1st month of the Quarter, and the 2nd month of the Quarter. In the last field (the 2nd month of the Quarter), you should indicate the amounts remitted from the 0619E forms you have filed from the first two months of the quarter. The Total Taxes Due will then be automatically computed by the eBIRForms and should be equal to the withholding amount payable for the 3rd month of the Quarter.

Step 4 - Check the details entered, then click the "Validate" button on the lower portion of the form. Once the validation is successful, click ”Save.”

Step 5 - You may now file your BIR Form 1601EQ. Just click “Submit / Final Copy” and you will be redirected to a BIR message. To complete the filing process, “OK”

If you wish to save a copy of your submitted form, click “File” on the top portion of the form. Then click “Print.” You may print a physical copy of the form or print it as a pdf file to retain a digital copy.

After filing, a tax confirmation receipt will be emailed to you through the email you entered in the Profile page.

Step 6 - Pay for the total tax payable.

Step 7 - Don’t forget to keep copies of the forms or returns you submitted. The tax confirmation receipt and the proof of payment will serve as a proof of your compliance.

Step 8 - Prepare and submit the Quarterly Alphalist of Payees (QAP).

How to prepare QAP using the BIR Module?

Step 1 - QAP can be generated and validated through the module made by the BIR. Download the BIR Module through their website, www.bir.gov.ph, under their Downloadables section.

Step 2 - After Downloading and installing the Alphalist Data Entry and Validation Module, open the application. The screen below will appear:

Step 3 - In the Username and Password field, enter your desired username and password; then click “Okay.” Make sure to remember the login credentials for future logins. After logging in, you will be redirected to the screen below:

Step 4 - Click the “Withholding Agent” button. You will be redirected to a screen where you will need to fill out some required information. Please see below for reference:

Step 5 - After filling out the details, Click ”Save,” and you will return to the screen shown in Step 3. Click the “QAP Form” button. Then choose the “1601E” button, and the 1601E Menu will open:

Step 6 - On the 1601E Menu, make sure to enter the correct month, year, and quarter wherein the withholding details are applicable., Then click “Add/Update” on the Schedule 1 portion. This will redirect you to the following screen:

Step 7 - You may now enter the information of the payees for whom you have withheld the income payments for the particular month. Just click the “Add” button to add other payees’ information and withholding amounts. Repeat this process for the remaining months of the quarter.

Step 8 - After entering all the required data for the quarter, return to the 1601E menu. Make sure to choose the correct quarter for the QAP. Then, click the generated DAT file and choose the folder where you will be saving the file. After generating the DAT File, close the “Alphalist Data Entry” application and open the “Alphalist Validation” application. The Alphalist Validation will validate and check if there are any errors in the information you inputted in the Alphalist Data Entry.

Step 9 - Upon opening the application, enter your TIN Number. Then click the “1601EQ” button:

Upload the generated DAT file and enter the applicable month. Then, click “Validate File.” An error message will be prompted in case of any issues in the DAT file. Repeat this process for the remaining months of the quarter. If there are any errors in the file, reopen the “Alphalist Data Entry” application and make the necessary corrections. Afterwards. you may go back and repeat the process starting from Step 8.

Step 10 - Once completed and there are no more error prompts, you may now submit the DAT File though the BIR’s email: esubmission@bir.gov.ph. In the subject line of your email, include your TIN, registered name, applicable quarter, and the QAP.

Example: 012345678 Sample Company Inc. Q1 QAP

Attached the generated DAT File to the email. Once the DAT File you submitted has been successfully sent and delivered, you will receive a confirmation email from the BIR. Upon receiving the confirmation email, you may save it as a pdf to retain a copy. This will serve as a proof of your compliance.

There you go! Understanding these tax forms may seem overwhelming but it is manageable with the right approach. Maintaining organized records and seeking guidance from tax professionals when needed are key steps to successfully manage your taxes. It's also essential to stay updated with the latest regulations and deadlines set by the BIR to ensure smooth and trouble-free tax compliance.

Still have questions about any of the tax deadlines? Book an online consultation

Got no time to comply with your tax deadlines? Get a Quote

Disclaimer: Numbers that Matter Inc. aims to curate topics that are simplified and easily digestible for micro, small and medium enterprises, by balancing our technical know-hows as accounting professionals and the practical experiences of our team working on ground with our clients. There may be technicalities intentionally omitted from our content to preserve its simplicity. Any practical tip is purely the opinion of the team and is merely informal advice, and thus, should not be taken as a definitive rule. Should you have any specific questions, feel free to message the team at consult@numbersthatmatterph.com and we’d be happy to discuss with you further.

Out of all the articles I read about BIR Form 0619E and 1601EQ, this is the easiest to grasp and less daunting. Very informative. Thank you for the article.